Ramon Israel on treating yourself every single day

TikTok star and food and lifestyle content creator Ramon Israel is an advocate for ‘living his best life’ – within reason. We caught up with the unashamedly honest Ramon about his current money mindset, hacks for saving on the Virgin Money app and learning lessons the hard way.

VM: You recently moved from Perth to Melbourne. How are you enjoying your new city?

RI: Yes, I moved four months ago. Perth was really comfortable, and it got to the point where things were a little too easy.

I was living at home at the time, I had lots of free time and life wasn’t structured, so I thought Melbourne would be a really good challenge.

I happened to be offered a job in an office here so the timing was perfect. However, I found the job, which was in marketing, wasn’t something I was super passionate about and, to be honest, I didn’t move here to be confined to an office.

I wanted to explore my content creation and see how far it can get me. I ended up leaving and now I am solely focusing on content creation.

It’s really challenging me because it is just me in my apartment, I pay all the bills and I am doing it all on my own. I am loving it. There is always something going on in this city.

VM: Moving is a costly exercise. Did you have to budget for it?

RI: Yes, it is! I moved to Sydney a couple of years ago so I knew I’d have to have at least $10,000 saved this time. The only difference is, I was with a partner last time and they helped me manage my funds for the move. This time around, I had to do it all on my own. I had furniture that had to be moved to Melbourne and I had to hire people to get me over here.

I have a safety net, where I have a certain amount put away, so I knew if I did choose to relocate, I would have enough to fund it. But yes, it was very expensive. I spent maybe another $10,000 setting everything up.

VM: Money can be an uncomfortable conversation but it is an important one. Would you agree?

RI: I feel like it is such a touchy subject but it shouldn’t be. We all spend and we all live our best lives but it is such a taboo thing to admit to spending money. We need more open conversations around budgeting and finances.

VM: How would you describe your spending habits?

RI: In general, I am the type of person that, if I see something I want, I will get it. This is something I am working on, particularly since I left my office job. I have to be a little stricter now, but I still have those tendencies that if I see something, I’ll buy it.

VM: What do you splurge on?

RI: Clothes and hotel staycations – things that make me feel really good inside. When I do go on those really nice trips, it’s just me, so I can really justify the solo love date.

VM: What do you cut back on when you need to save?

RI: Coffee. I literally just bought myself sachets because I need to cut down on my coffee spending. There is such a strong coffee culture here in Melbourne and small things like coffee add up.

VM: How would you describe your current money mindset?

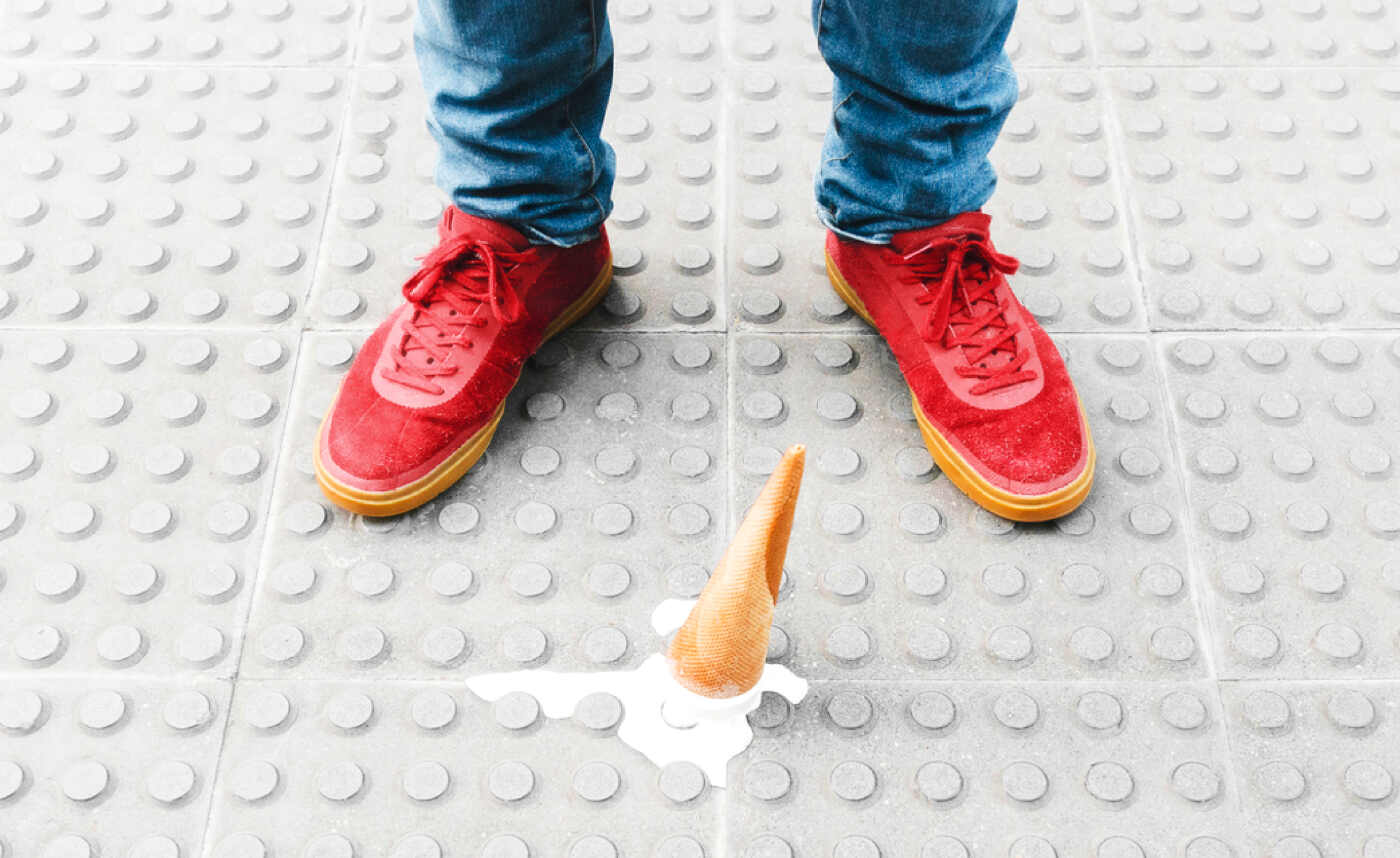

RI: For me, it is still ‘treat yourself’ but I have boundaries so I don’t go overboard. It’s about having a safety net to ensure I am covered but still allowing myself to live my life, enjoy my money and explore.

VM: Any financial milestones you want to hit in the near future?

RI: I really want to get a puppy. I understand that is such a big responsibility financially with vet fees, puppy school, and food bills, but in the long term, my goal would be saving up to support an animal. Right now, I am testing the waters to see if I can financially support myself as a full-time content creator. After three more months, I will be able to decide whether I am ready to take care of an animal.

VM: Have you learnt any money lessons the hard way?

RI: I once spent $1,800 to fly to Melbourne to go on a date. It was a really poor decision because I touched money I shouldn’t have.

At the time, I was freelancing as a dance teacher. When you freelance, you take care of your own superannuation, so each pay I put a percentage of earnings into an account and that would be my super. At the end of the year, I planned to put that money into my superannuation account. I had access to that money so I spent most of that to get to Melbourne for the date. It was a big lesson, as I had to put the money back, which I did, but I would never do that again – especially to spend that much on a flight. That was ridiculous.

VM: What are some of your favourite features of the Virgin Money app to save money?

RI: Definitely using the spend tracker budget feature. Once I see how much – and where – I've spent within the month, I use the monthly budget tracker to keep myself accountable and work on creating better spending habits.

It does take discipline, but when you're constantly earning points just for being you, it is possible. My monthly tracker showed me that I was spending the majority of my income on beauty services, so for next month, I set a budget of under $250 for this category. I am looking forward to seeing myself achieve this goal.

Get money fit and live your best life with the Virgin Money app.

You can use the app to track your spending, set budgets, stay on top of your bills and lock down your long-term savings so you can treat yourself when it matters most.